Real Estate Investing: My Personal Experience & Top Tips

When it comes to real estate investing, I put my money where my mouth is. In addition to owning my own home, I’ve made it a priority over the years to buy and sell investment property.

When it comes to real estate investing, I put my money where my mouth is. In addition to owning my own home, I’ve made it a priority over the years to buy and sell investment property.

Why? Because investing in real estate allows you to collect monthly rental income, build equity, diversify your portfolio, and receive tax breaks.

Long-Term: An Increase in Value Over Time

The usual goal is to invest in properties that increase in value over time. I’ve had personal success doing this and have worked with many clients who’ve been successful, as well.

Short-Term: House-Flipping

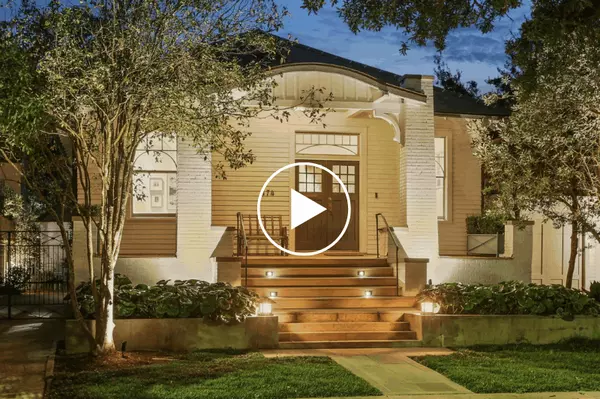

I’ve also worked with several clients who enjoy the short-term real estate investment process of house-flipping -- renovating an old home that needs some love, transforming it into a wonderful new space, often adding more square feet to add value, and selling it to a lucky new owner. Check out some of the beautiful house-flips I’ve sold at 1448 N. Miro St, 5508 Annunciation St, 5354 Laurel St, and 919 General Taylor St.

How to Avoid Capital Gains Taxes

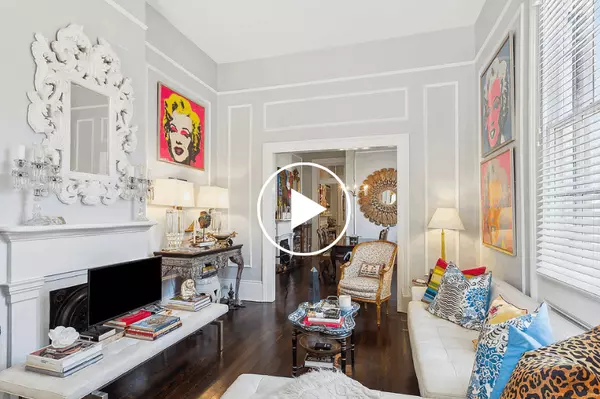

A third type of real estate investment involves renovation, owner occupying, and then flipping the property after two years' time, which allows the owner to avoid paying capital gains taxes. Some of my designer clients do this, and here’s an example of a home I sold for friend and designer Jamie Meeks.

Want my top tips for real estate investing? Read on.

- If you’re hesitant to invest by yourself, get a partner! That’s what I did back in 2003, when I bought my first investment property (just seven months after I got my real estate license). My friend and mortgage lender Debbie Campo was my investment partner, and we flipped that property six months later for 20K more (without making property improvements). We also bought an Irish Channel double in 2004 that I still own. After the experience of buying a third property with Debbie, I felt confident enough to invest on my own.

- Get a good lender. (See Debbie Campo, above. I’m happy to recommend others, as well.)

- If you buy in up and coming neighborhoods, you’ll likely get a better return on investment. Want recommendations on neighborhoods? Let’s talk.

- Holding a property long term can be key. As a neighborhood grows and changes, the value of a property will continue to increase over time.

- Your rental income should cover your note. You’ll want to look at what the current income is and what it has the potential to be.

- Check out the New Orleans’ weekly Sheriff’s sale and real estate auction. Sometimes all that’s needed is painting and other small cosmetic improvements in order to flip a property for a profit.

- Consider 1031 exchanges. A 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred.

Interested in buying, selling, or investing? When you’re ready, I’m happy to talk about all of this and more.

Categories

Recent Posts