FEMA Risk Rating 2.0 and What It Means for You

You may (or may not) have heard something about FEMA’s new Risk Rating 2.0. And you might be nervously wondering how it could affect you and your flood insurance policy premiums here in New Orleans, LA.

So Let’s Take a Deep Breath, and Break It All Down

What is FEMA Risk Rating 2.0? The following is from the fema.gov web site:

FEMA is updating the National Flood Insurance Program‘s (NFIP) risk rating methodology through the implementation of a new pricing methodology called Risk Rating 2.0. The methodology leverages industry best practices and cutting-edge technology to enable FEMA to deliver rates that are actuarially sound, equitable, easier to understand and better reflect a property’s flood risk.

What Does This Mean?

- The whole point of FEMA’s new flood Risk Rating 2.0 Program is to make flood insurance rates more equitable, so that everyone pays their fair share. That means that individual properties will be assigned their own individual risk rate vs. a seemingly random group rate that applies to a whole area or neighborhood.

- These changes affect everyone in the U.S. – not just New Orleanians or those near the Gulf coast. To make the program more sustainable for the country, we’ll all need to adjust and adapt.

- The new rating system will go into effect for new flood insurance policies starting October 1st, 2021, while changes to existing policies will be phased in starting April 1, 2022. And here’s some good news: increases to existing policies will be capped at 18% annually and phased in over a number of years. So, if your premium increases (which is likely), it will do so over time – not all in one lump sum!

What If You’re Staying in the House You Currently Own?

Even if your premium does increase, annual increases won’t exceed 18%. So for example, if your annual flood premium is $1000, your increase for the first year would be capped at $180. After that, annual increases will take place each year until you reach your new flood risk rate.

Your insurance agent can give you a better idea of what that new flood risk rate will be, and if possible, you can make a plan to start saving for the increase. Note: make sure to stay within the 30-day grace period to pay the premium on your existing policy; if you don’t, you’ll need to get a whole new policy, and you’ll lose the advantage of those incremental increases.

What If You’re Looking to Buy?

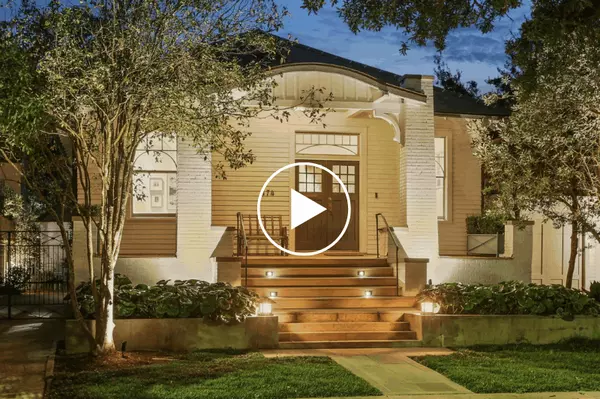

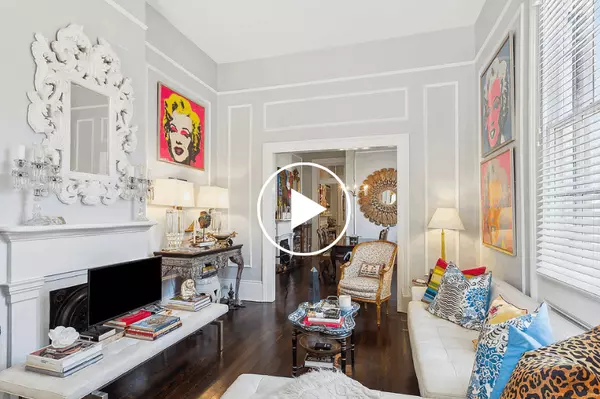

If you’re looking to buy, it will probably be in your best interest to assume a seller’s existing flood insurance policy, so that you can take advantage of incremental increases over time. If that’s not possible, I can work with you to get flood insurance quotes before you even make an offer on a home. I’m happy to explain further! Let’s talk.

What If You’re Looking to Sell?

If you’re selling, your existing flood insurance policy may be more attractive to a buyer than if they have to purchase a new policy. (For the reasons I explained above.) If that’s not possible, I can work with you to get flood insurance quotes before you list your property, so that any potential buyers have all the information up front, with no surprises down the road.

Trusted Resources For You:

There’s more to understand about how the new rating system works, and I’m here to help! I’m also happy to recommend the following insurance folks. They’re my trusted resources, and I’ve worked with them for years:

Alyssa Bourgeois, Eustis Insurance & Benefits

504-636-4844

Zachary Fanberg, Eagan Insurance

504-866-9638 (office), 504-214-3675 (cell)

Chris Schmidt, Brightway Insurance

504-930-4460

Greg LaGrange, Hartwig Moss Insurance Agency

504-525-9901

Categories

Recent Posts