An Architectural Landmark that’s a Haven for Out-of-Towners

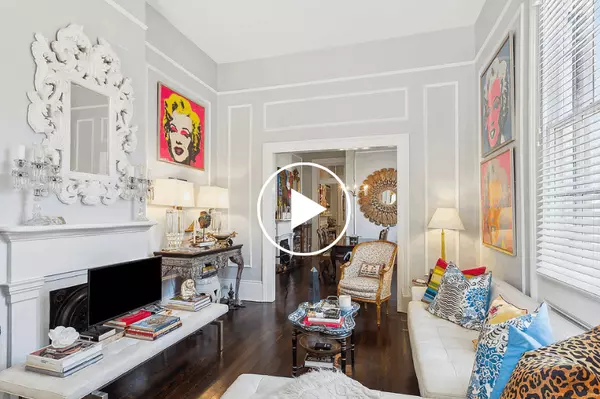

Nine years ago, Aaryanne and Rick Preusch visited New Orleans with friends who owned a condo in the city. Looking back, Aaryanne says now, “We had so much fun that weekend, we decided we needed a condo here, too!” Soon after, they found my listing at St. Elizabeth’s for a corner condo with breathta

Shoe Lovers Unite

Shoes Make the Woman Someone once said to me, “As long as you’ve got on a cool pair of shoes, you’re good.” And I’ve gladly lived by that adage ever since. If you’re a shoe lover like I am, you believe that accessories make the outfit. All I’ve ever wanted to shop for was shoes. And clearly, I’m ob

7 Ideas for Summer Fun In and Around New Orleans

How can you beat the heat and enjoy some summer fun, New Orleans-style? With a slew of ideas that keep things easy and breezy. Get my tips below: 1. Try a coffee shop that’s new to you. We all play favorites, but why not check out a different spot and taste-test their iced coffee or affogato? It’s

Categories

Recent Posts